Table of Content

If you do change jobs, it’s best to stay in your field or profession. This can be very doable for existing homeowners, especially in areas with rapidly rising home prices since you’ve probably accumulated more equity in your home. That equity can be used to make a down payment on your next home. So what’s the best way to improve your DTI for the best possible interest rate?

Someone who knows the VA guidelines and can quote you a real rate based on your individual profile and make sure you are getting the best deal in utilizing your VA benefits. You’ll go through a private bank, mortgage company, or credit union—not directly through us—to get an IRRRL. Terms and fees may vary, so contact several lenders to check out your options. Once you’ve done that, if you’re able, look at your installment loans. These days, most can be paid early without incurring a prepayment penalty. Confirm this with your lender before you make any early payments.

Today’s VA Mortgage Rates

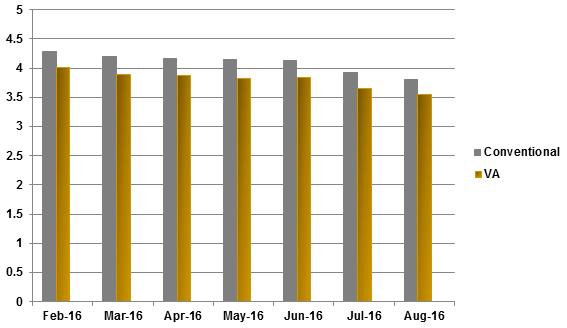

Below, you can see how a VA loan differs from a conventional 30-year fixed mortgage. The above mortgage loan information is provided to, or obtained by, Bankrate. Some lenders provide their mortgage loan terms to Bankrate for advertising purposes and Bankrate receives compensation from those advertisers (our "Advertisers"). Other lenders' terms are gathered by Bankrate through its own research of available mortgage loan terms and that information is displayed in our rate table for applicable criteria. According to a VA loan APR survey, the national average for a 30-year loan was 2.920% on Friday, November 26, 2021.

Not only a VA mortgage lender, USAA provides a full breadth of financial services, including insurance, lending, banking, investment and retirement planning. USAA’s products and services are exclusive to military customers. It provides both conventional mortgage products as well as VA primary, refinance, jumbo and cash-out loans.

What is a VA cash-out refinance loan?

Buyers have to be under contract in order to be eligible for a rate lock. Once that’s in hand, the timeline can vary depending on a host of factors, including the type of loan, the overall economic environment and more. USAA offers personalized service during the jumbo loan process, and you can finance the VA funding fee.

To get a better idea about your potential savings, you can use a refinance calculator. It’s important to understand that buying points does not help you build equity in a property—you simply save money on interest. By refinancing an existing loan, the total finance charges incurred may be higher over the life of the loan. Get a Quote A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency.

Current VA loan rates

The amount of the VA funding fee depends on the percent of your down payment and whether this is your first VA-backed home loan. The fee is generally paid at closing or financed into the mortgage. To get an estimate of your VA funding fee costs and mortgage expenses, visit Zillow’s VA mortgage calculator. Lenders can offer low-cost loans through the VA lending program because the Department of Veterans Affairs provides a guaranty for part of your loan’s value. The lender would be compensated if you couldn’t repay the loan. Conventional loans don’t offer this guaranty, and thus need to charge expensive private mortgage insurance to protect lenders from financial loss.

With some types of mortgages, the interest rate you pay when you refinance your loan is higher than the one you pay when you’re purchasing a home. Since VA mortgage rates are set by individual lenders, rather than the VA itself, there can be a wide range across the market. Well, that guarantee from the federal government means VA loans are less risky than others. The goal of the VA loan program is to make homeownership more accessible for veterans and service members.

Veterans United offers 30-year and 15-year fixed loan options with competitive APR percentages and touts high rates of customer satisfaction. You do not need private mortgage insurance or have to pay mortgage insurance premiums. You should get a loan estimate from multiple lenders and compare the loan offers using the Consumer Financial Protection Bureau’s guide. A VA loan is almost always the best type of mortgage you can get if you’re eligible. You apply for one with a bank, lender, or credit union, just like any other home loan.

The type of VA refinance loan, the borrower's credit score, the loan-to-value ratio, and other factors can all play a role in VA refinance rates. On average, VA loan rates are typically lower than both FHA and conventional mortgage rates. VA loan rates are generally lower due to the VA backing a portion of each loan.

Currently, Quicken Loans offers 30-year, 25-year, and 15-year fixed VA loans with VA home loan rates of 3.75%, 3.75% and 3.125%, respectively. The APR for 30-year, 25-year and 15-year fixed loans is 4.21%, 4.282% and 3.931%, respectively. You can pay the funding fee either by including it in your overall mortgage loan and pay it off over time, or you can choose to pay the full fee at closing.

As such, VA loans offer unique benefits not available to most other borrowers. Average rates are based on a daily survey of our lender network. Your own VA loan rate will likely be higher or lower depending on factors like your credit score and down payment. Like before, though, thanks to the federal government guaranteeing the VA mortgage, most borrowers will still see a lower interest rate even if their credit isn’t perfect.

The VA inspection is much more in-depth than the home appraisal. Any calculators or content on this page is provided for general information purposes only. Casaplorer does not guarantee the accuracy of information shown and is not responsible for any consequences of its use. I personally think that is a good rate, seen one as high as 8% a couple weeks ago.

You cannot use a VA loan to purchase land by itself, even if you intend to build a home later. You must be building a house at the same time in order to be eligible. The mortgage industry calls this your “DTI” (debt-to-income ratio). There are also qualifying exceptions for those discharged owing to a service-related disability, hardship, early out, and certain other causes. Whatever your type of service, you’ll need an honorable discharge to qualify. We’ve compiled some of the most common mortgage rate questions below so that you can make more informed decisions.

No comments:

Post a Comment